Medicare Advantage plans (Medicare Part C) are an alternative way of receiving your Medicare Part A and Part B (Original Medicare) covered services through a managed care organization. Medicare Advantage plans can include additional benefits Original Medicare doesn’t cover, such as prescription drug coverage.

Medicare Advantage plans are widely used in the United States. More than 34 million people are enrolled in Medicare Advantage plans, which is over half of all adults eligible for Medicare.1

We offer plans from Humana, UnitedHealthcare®, Anthem Blue Cross and Blue Shield*, Aetna, HealthSpring, Wellcare, or Kaiser Permanente.

Enrollment may be limited to certain times of the year. See why you may be able to enroll today.

Compare plans today.

Speak with a licensed insurance agent

What does Medicare Part C cover?

All Medicare Advantage plans include the same standard benefits as Original Medicare.

Medicare Advantage plans can also provide prescription drug coverage, routine vision care and/or hearing benefits. Plan availability varies, and plans with these benefits may not be available where you live.

Some types of plans such as Health Maintenance Organization (HMO) plans require you to see in-network health care providers for covered services.

More info: What does Medicare Part C cover?

How much does Medicare Part C cost?

If you enroll in a Medicare Advantage plan, you may have to pay some or all of the following expenses:

- Original Medicare premiums

- Medicare Advantage plan premiums

- Out-of-pocket costs such as copayments, coinsurance and deductibles

Who is eligible for Medicare Advantage plans?

There are 2 general eligibility requirements to qualify for Medicare Part C:

- You must be enrolled in Original Medicare (Part A and Part B)

- There must be a Medicare Advantage plan offered in your area

If your Medicare Advantage plan does not include prescription drug coverage, you may be allowed to add a Medicare Part D plan as well.

More info: Medicare Advantage eligibility

Compare plans today.

Speak with a licensed insurance agent

When can I enroll in Medicare Advantage?

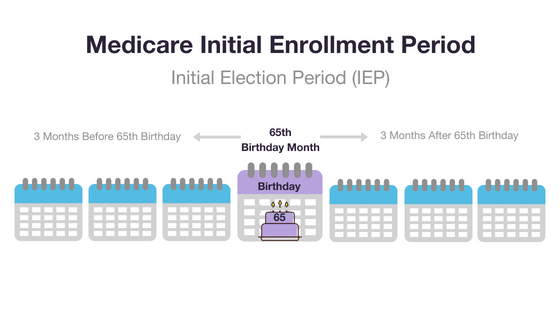

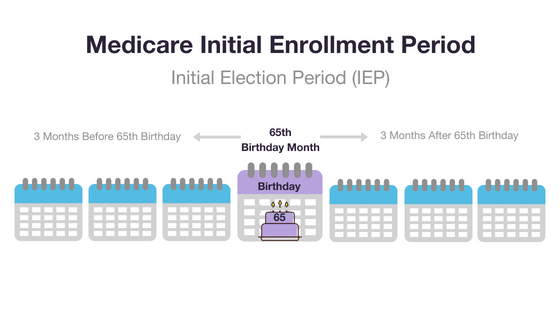

Medicare requires that you enroll in, disenroll from, or make changes to your Medicare Advantage plan only during pre-determined enrollment periods.

If you are enrolling for the first time, your first opportunity to join a plan is typically during your Initial Enrollment Period, unless you qualify because you have a certain disability.

Your Initial Enrollment Period occurs around your 65th birthday, or around your 24th month of disability (if you’re under 65 and eligible for Medicare).

If you don’t enroll in a Medicare Advantage plan during your Initial Enrollment Period, your first opportunity to enroll will typically be during a Special Enrollment Period (SEP), if you qualify for one.

You also may be able to join or switch plans during the Annual Election Period (AEP, also commonly called the Fall Medicare Open Enrollment Period for Medicare Advantage plans), which runs from October 15 to December 7 every year.

There are also Special Enrollment Periods (SEPs) that may let you join a plan outside of the main enrollment periods, depending on your circumstances.

Qualifying circumstances for a Medicare Special Enrollment Period include, but aren't limited to:

- Moving outside of your current plan's coverage area

- Moving to an area where additional coverage options exist

- Losing employer coverage

- Moving into or out of a skilled nursing facility

More info: How to apply for a Medicare Advantage plan

Compare plans today.

Speak with a licensed insurance agent

What are the different Medicare Part C plans?

The number of Medicare Advantage plans available to you will depend in part on where you live and how many companies offer coverage in your area.

There are several types of Medicare Advantage plans, including:

- Health Maintenance Organizations (HMOs)

These plans feature a network of participating health care providers.

With a Medicare HMO, you typically select a primary care physician (PCP). Your PCP coordinates your care and makes referrals to specialists within your plan network when you need additional care.

Your coverage is generally limited to only the providers within the HMO plan network.

- Preferred Provider Organizations (PPOs)

A Medicare PPO plan typically features a network of providers.

Unlike an HMO plan, a PPO plan may allow you to receive covered services from providers outside of the plan network, though you may pay higher out-of-pocket costs when you go outside of the network.

PPO plans typically do not require you to have a primary care physician, and you typically aren't required to get a referral to see a specialist.

- Private Fee-for-Service (PFFS) plans

A PFFS plan may not feature a network of preferred providers. You can typically visit any health care provider who accepts Medicare and the terms and conditions of your plan.

- Special Needs Plans (SNPs)

A Special Needs Plan is a certain type of Part C plan that is designed for people with a specific health condition, those who are dual-eligible for Medicare and Medicaid, or who reside in residential facilities or institutions.

The type of plan you choose may affect your prescription drug coverage options, referral requirements and network restrictions.

More info: Medicare Advantage plan options

How do I compare Part C plans?

You should consider a number of factors before enrolling in a specific Medicare Advantage plan:

- Type of plan

- Benefits

- Star rating2

- Costs

A licensed insurance agent can help you compare the above information for the Medicare Advantage plans that are available where you live.

More info: Compare Medicare Advantage plans

Do I need Medicare Part C?

A Medicare Advantage plan allows you to bundle your Medicare Part A and Part B benefits into a single plan.

If want coverage for prescription drugs and/or other benefits that aren't covered by Original Medicare, you may want to consider a Medicare Advantage plan that offers those benefits.

Medicare Advantage plans also include an annual out-of-pocket spending limit, which Original Medicare doesn't offer.

Speak with a licensed insurance agent to learn more about whether a Medicare Advantage plan may be right for you.

Compare plans today.

Speak with a licensed insurance agent